At The Concept Trading, we encourage traders to have a risk management solutions tailored specifically for proprietary traders. Understanding the nuanced dynamics of trading in volatile markets, we equip our clients with the tools and strategies necessary to identify, assess, and mitigate risks effectively. Our approach combines advanced analytics with personalised consultation, empowering traders to make informed decisions while safeguarding their capital. Whether it’s setting appropriate stop-loss levels, diversifying portfolios, or employing hedging techniques, our expert team is dedicated to optimising your trading performance and ensuring you navigate the complexities of the financial landscape with confidence and clarity.

Most traders risk far too much in an attempt to pass the challenge stage quickly. Research shows that even the best traders rather than risk 1-2%, generally risk only 0.5% of the account or less on any one trading opportunity, aiming for a mimimum of 2:1 reward to risk.

Consistency and following your trading plan is the key to getting fundeded and account longevity.

Market Volatility and Its Implications

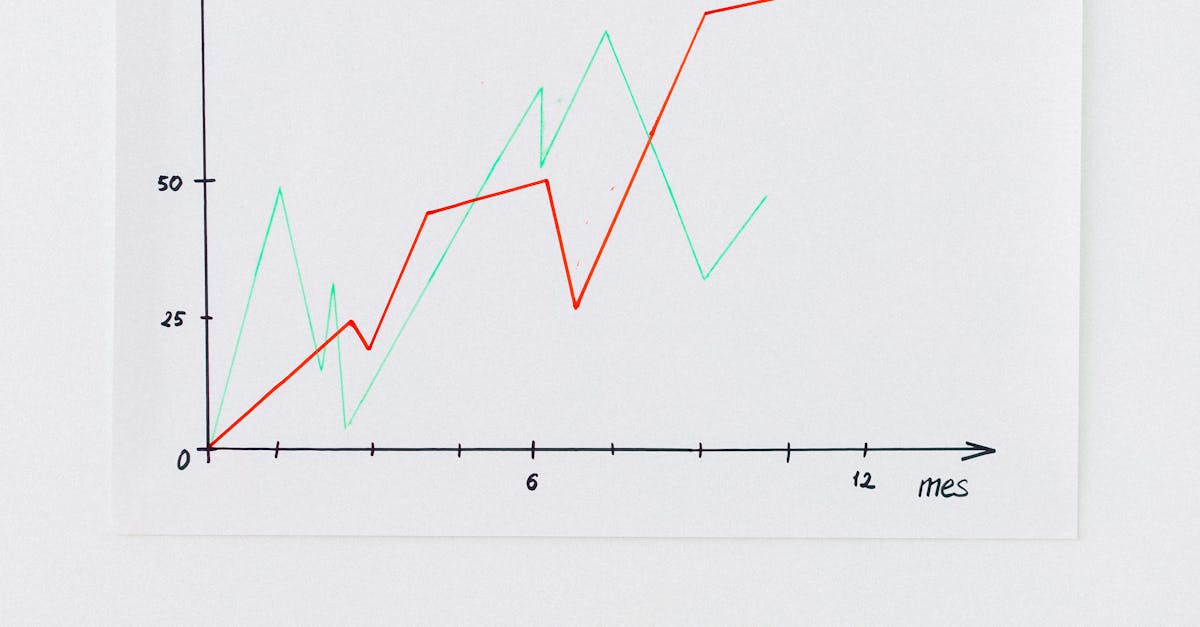

Market volatility presents both challenges and opportunities for proprietary traders. Fluctuating price levels across various asset classes can result in significant profit potential, particularly when leveraging positions. However, it also opens up the risk of substantial drawdowns, making effective risk management strategies vital. Traders must evaluate their exposure regularly to ensure that they do not succumb to the emotional stress often associated with rapid market changes. Tools such as stop-loss orders and diversified portfolios are essential to mitigate risks, allowing traders to navigate through periods of heightened volatility with a level of confidence.

Understanding the implications of market volatility extends to the psychological aspects of trading. Fear and anxiety can influence decision-making, leading to impulsive choices that may jeopardise long-term profitability. Discipline plays a crucial role in maintaining a trading strategy aligned with predefined parameters, especially during turbulent market conditions. Stress testing different scenarios helps traders to anticipate potential failures in their strategies and allows for adjustments. By integrating both systematic protocols and an awareness of psychological triggers, traders can better position themselves in the complex landscape of financial markets.

Navigating Fluctuations in Financial Markets

The forex market is renowned for its volatility, which can create both substantial opportunities and significant risks for proprietary traders. A shift in market trends can occur within minutes, demanding immediate and informed decision-making. Understanding the nuances of market shifts requires a combination of analytical skills and emotional control. Traders often experience pressures from potential gains and losses, which can lead to impulsive decisions driven by greed or fear. Developing a robust risk management framework is crucial for navigating these fluctuations effectively, allowing traders to maintain a level of objectivity amidst the chaos.

An essential aspect of managing volatility is scenario analysis. By assessing different market conditions and their potential effects on investments, traders can better prepare for sudden shifts. Leveraging technologies and analytics not only enhances trading decisions but also aids in identifying patterns that may indicate where the market is headed. Successful traders learn to diversify their portfolios and hedge their positions to mitigate risks associated with rapid price movements. Building these habits can empower traders, transforming their mindset from reactionary responses to strategic planning in the ever-changing financial arena.

Tools for Real-Time Risk Monitoring

Effective risk monitoring is essential for prop traders, particularly in an environment marked by price fluctuations. Trading platforms equipped with sophisticated software provide real-time market data, enabling traders to assess asset prices comprehensively. These tools often include risk calculators that help measure potential slippage and overleveraging, assisting users in aligning their trading activities with their risk appetite. By integrating such technologies, traders can refine their strategies and make informed decisions that mitigate potential losses while capitalising on profitable opportunities.

Moreover, the complexity of financial markets necessitates a robust approach to risk assessments. Many platforms now offer features that allow investors to diversify their investments effectively across various instruments, such as forex and futures contracts. These risk management capabilities serve as a compass for traders seeking to navigate the turbulent waters of market volatility. By employing real-time monitoring tools, traders can enhance their understanding of systemic risks and adapt their strategies, ensuring sustainable growth even in challenging market conditions.

Technologies Enhancing Trading Decisions

Technological advancements have significantly reshaped the landscape of trading, offering tools that help traders make informed and timely decisions. Data analytics has emerged as a vital resource for understanding market trends and predicting asset price movements. By utilising real-time data feeds and sophisticated algorithms, traders can execute high-frequency trading (HFT) strategies more effectively. These tools enhance the ability to identify patterns, optimise entries and exits, and assess risk through various analytical methodologies, including technical analysis.

Furthermore, the integration of AI and machine learning enables traders to refine their strategies continually. They can simulate market conditions to stress-test their approaches, ensuring resilience against potential volatility. Innovations like stop-loss orders and margin requirements further empower traders to manage risks proactively. In an environment characterised by rapid changes and systemic risks, having access to reliable trading systems and cybersecurity measures is crucial for protecting investments and maintaining a competitive edge.

Psychological Aspects of Trading

Emotions play a significant role in trading, often influencing decisions and strategies. Traders may experience fear, greed, or anxiety, which can lead to impulsive actions, affecting performance and risk management. Recognising these psychological triggers is crucial for maintaining discipline in volatile markets. Developing techniques to cope with such emotions can help traders adhere to their predetermined risk tolerance and avoid deviating from their strategies.

Building mental resilience allows traders to remain composed during market fluctuations. This is particularly essential when engaging in high-stress activities like foreign exchange trading or algorithmic trading. Establishing a personal checklist for risk identification and adhering to it can provide a structured approach to mitigate emotional influences. Regularly reviewing trading performance and reflecting on emotional responses can foster a deeper understanding of one's psychological landscape, paving the way for improved decision-making in future trades.

Managing Emotions in High-Stress Environments

The ability to maintain composure during market fluctuations is crucial for prop traders. Psychological resilience serves as an essential attribute in navigating high-stress environments, particularly when facing economic downturns or unexpected market sentiment shifts. This involves recognising personal biases that can cloud judgment, such as overconfidence or anchoring on past gains. Traders must cultivate a mindset that prioritises rational, rather than emotional, responses to market movements, ensuring decisions align with their risk appetite and overall investment strategy.

Education plays a critical role in developing effective coping mechanisms for stress. Ongoing training and simulations can enhance emotional control by preparing traders for the unpredictable nature of derivatives trading and market liquidity challenges. Tools like dashboards can assist in tracking performance, offering insights that reduce reliance on memory and hindsight. Such measures foster accountability, enabling traders to reflect on decisions critically without succumbing to psychological vulnerabilities that could jeopardise profitability.

FAQS

What is risk management in the context of prop trading?

Risk management in prop trading involves identifying, assessing, and mitigating potential losses that traders may face while executing trades. It includes setting limits, using stop-loss orders, and employing various strategies to protect capital.

How does market volatility affect prop traders?

Market volatility can significantly impact prop traders by creating rapid price fluctuations, which can lead to increased risks and potential losses. Effective risk management strategies are essential to navigate these fluctuations and protect against unforeseen market movements.

What tools can prop traders use for real-time risk monitoring?

Prop traders can utilise a variety of tools for real-time risk monitoring, including trading platforms with built-in analytics, risk assessment software, and market data feeds that provide instant information on price movements and volatility.

How can technology enhance trading decisions in prop trading?

Technology enhances trading decisions by providing traders with advanced analytical tools, algorithmic trading systems, and real-time data analytics. These resources help traders make informed decisions quickly and adjust their strategies as market conditions change.

What are some psychological aspects of trading that prop traders should manage?

Prop traders should manage several psychological aspects, including emotional responses to market fluctuations, stress management, and maintaining discipline. Developing a strong mindset is crucial for making rational decisions rather than impulsive ones during high-pressure situations.