Table Of Contents

Breaching Stop Loss Limits

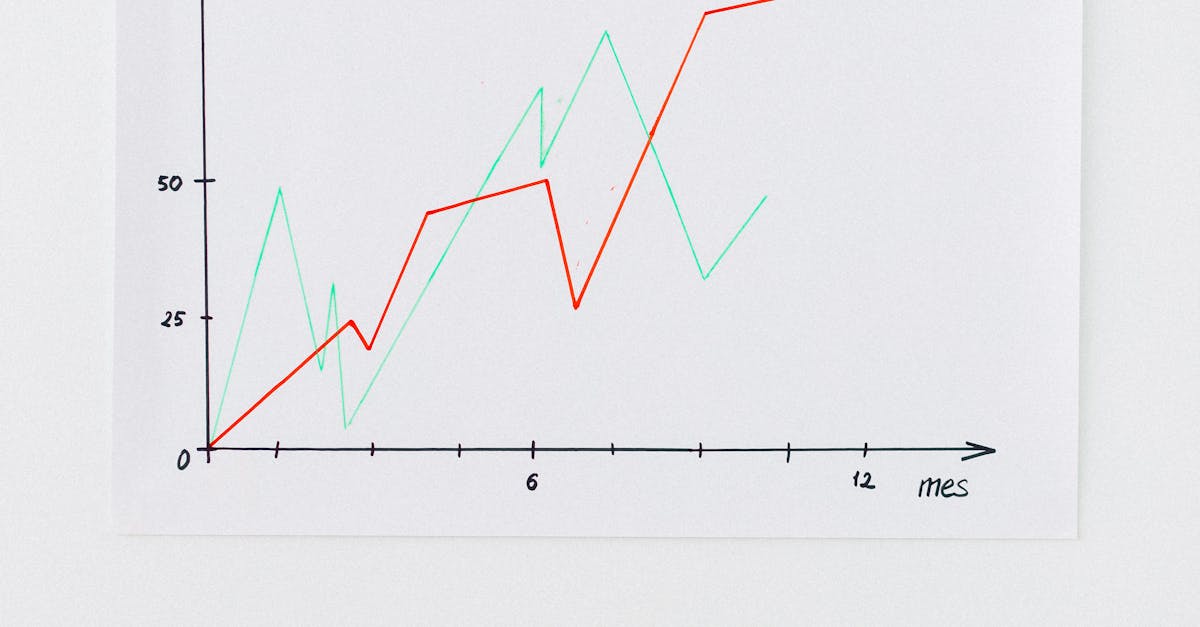

Breaching stop loss limits is a prevalent issue among funded accounts, as traders often underestimate market volatility or overestimate their ability to predict price movements. By failing to honour these predefined exit points, traders expose themselves to larger losses than anticipated. This misconduct can jeopardise their funded accounts, leading to adverse outcomes that could have been mitigated through effective risk management strategies.

Effective risk management for prop traders in Queensland, hinges on adhering to stop loss limits. Establishing these boundaries allows traders to maintain control over their financial exposure and fosters a disciplined approach to trading. When traders ignore their stop loss orders, they not only increase the potential for significant losses but also disrupt their overall trading strategy, making recovery from such setbacks significantly more challenging.

The Importance of Stop Loss Orders

Stop loss orders play a crucial role in the trading strategies of prop traders, acting as a safety net against significant losses. They automatically close a position once it reaches a predetermined price, preventing further declines. This mechanism provides traders with greater control over their investments, allowing them to establish clear exit points and maintain discipline in volatile markets.

For those engaging in risk management for prop traders, Queensland, implementing stop loss orders is essential in navigating the uncertainties of trading. These orders not only protect capital but also help traders stick to their risk tolerance levels. By integrating stop loss orders into their trading plans, investors can alleviate some pressure, enabling them to focus on making informed decisions rather than reacting emotionally to market fluctuations.

Lack of Diversification

Investors often face the significant risk of concentrated investments when they channel their funds into a limited number of assets. This approach can lead to detrimental outcomes if those specific assets underperform. By not diversifying, traders expose themselves to market volatility, which can swiftly erode their capital. To mitigate this risk, it is vital for investors to spread their investments across various sectors and asset classes, ensuring a more stable portfolio.

In regions Queensland, effective risk management for prop traders is especially crucial given the local economic landscape. The absence of diversification can amplify losses during market downturns. Prop traders should consider a broader range of assets to protect against potential downturns in any single investment. Customising their risk management strategies is essential to navigate the complexities of the market more effectively.

The Risks of Concentrated Investments

Investing heavily in a single asset or sector significantly increases exposure to market volatility. This concentration can lead to severe losses if the chosen investment underperforms or experiences a downturn. A diversified portfolio is essential to mitigate these risks, as it spreads investments across various assets, thus reducing the impact of poor performance from any one investment.

For those involved in trading, especially in regions like Queensland, effective risk management becomes paramount. Strategies that encourage diversification can assist prop traders in maintaining a more stable return profile while minimising potential losses. Understanding the broader market landscape and incorporating multiple asset classes into one's trading strategy can serve as a safeguard against the pitfalls of concentrated investments.

Ignoring Market Conditions

Ignoring market conditions can lead to substantial losses for traders who are unprepared for sudden shifts in the financial landscape. Economic indicators such as inflation rates, employment data, and consumer spending play a crucial role in shaping market sentiment and determining asset prices. A trader who overlooks these factors may find themselves exposed to volatility, resulting in unexpected downturns in their portfolio.

For prop traders in Queensland, effective risk management requires a keen understanding of how current events influence market behaviour. Staying informed about local and global economic trends can provide valuable insights, enabling traders to make informed decisions. Engaging with market analysis tools and resources can enhance their strategies, ensuring they remain resilient in fluctuating conditions.

The Impact of Economic Indicators

Economic indicators play a crucial role in influencing market conditions and can drastically impact trading decisions. These indicators, which include employment rates, inflation data, and GDP growth, provide insights into the overall health of an economy. Traders who ignore these factors may find themselves unprepared for sudden market shifts, leading to significant losses in their funded accounts. Risk management for prop traders in Queensland is essential, as a keen awareness of economic indicators can help inform timely and strategic trading choices.

Market conditions can be treacherous, particularly when unexpected economic news disrupts investor sentiment. Events such as central bank announcements or geopolitical tensions can create volatility that might catch traders off guard. By maintaining an up-to-date knowledge of economic indicators, traders can better anticipate potential market movements and adjust their strategies accordingly. For prop traders in Queensland, this approach is integral to effective risk management, allowing them to navigate the complexities of trading environments with greater confidence.

FAQS

What are the most common risk violations in funded accounts?

The most common risk violations in funded accounts include breaching stop loss limits, lack of diversification, and ignoring market conditions.

Why are stop loss orders important in managing risk?

Stop loss orders are crucial because they help investors limit potential losses by automatically selling a security when it reaches a predetermined price, thus protecting the account's capital.

How can lack of diversification affect my investment portfolio?

Lack of diversification can increase risk significantly, as concentrated investments in a few assets make your portfolio vulnerable to market fluctuations, potentially leading to larger losses.

What market conditions should I pay attention to when managing a funded account?

Investors should monitor economic indicators such as interest rates, inflation rates, and employment data, as these can impact market performance and influence investment decisions.

How can I avoid common risk violations in my funded account?

To avoid common risk violations, establish and adhere to stop loss limits, diversify your investments, stay informed about market conditions, and regularly review your investment strategy.