Table Of Contents

Implementing Monitoring Systems

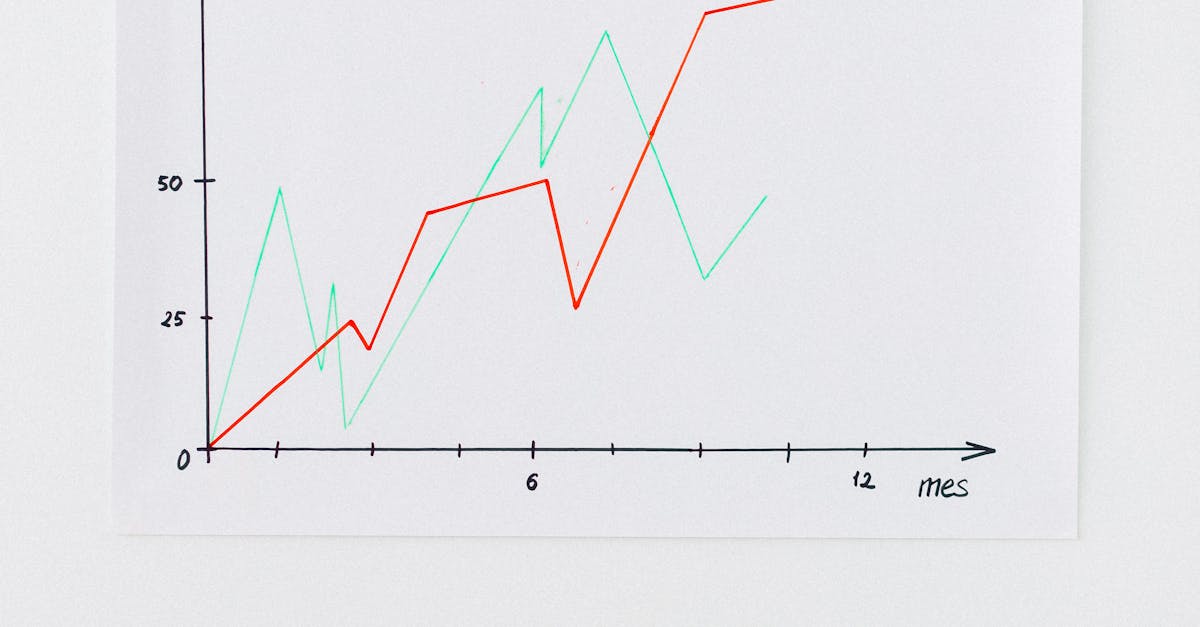

Implementing monitoring systems is crucial for effective risk management for prop traders. These systems provide real-time insights into trading activities, enabling traders to identify potential risks before they escalate. Automation tools can streamline data collection and analysis, allowing for faster decision-making. Monitoring software can also help track key performance indicators, ensuring that traders remain aware of their positions and exposure levels.

Incorporating a variety of monitoring tools enhances the ability to respond to market fluctuations or unexpected changes. Risk dashboards can visualise data, offering a comprehensive overview of risk factors in a single platform. Regularly reviewing these systems ensures they meet the evolving needs of traders, allowing them to adapt swiftly in a dynamic market environment. This proactive approach solidifies the foundation for ongoing risk management, fostering a culture of vigilance among traders.

Tools and Technologies for Risk Monitoring

A variety of tools and technologies are essential for effective risk monitoring in any trading environment. Advanced trading platforms often come equipped with built-in risk management functionalities such as real-time analytics, automated alerts, and portfolio risk assessments. These features are particularly beneficial for prop traders in Mulgildie, Queensland, where the ability to swiftly respond to market shifts can significantly impact trading outcomes. Utilising these platforms helps maintain a clear overview of potential risks, ensuring traders can make informed decisions promptly.

In addition to trading platforms, software solutions specifically designed for risk management offer enhanced capabilities. These tools often provide comprehensive reporting features and scenario analysis that allow traders to simulate various market conditions. By leveraging such technologies, prop traders in Mulgildie can identify vulnerabilities within their portfolios. Integration of these systems fosters a proactive approach to risk management, equipping traders with the insights needed to navigate unpredictable market dynamics effectively.

Engaging Stakeholders in Risk Management

Involving stakeholders in the risk management process is essential for creating a comprehensive plan tailored to the unique challenges faced by prop traders. Engaging team members from various levels ensures a broader perspective, which can identify potential risks that might otherwise be overlooked. Regular communication with these stakeholders fosters a culture of shared responsibility and encourages proactive contributions to risk strategies. Workshops and feedback sessions can be effective ways to involve them actively, ensuring their insights inform the risk management framework.

For prop traders in Queensland, establishing a collaborative environment can significantly enhance the effectiveness of risk management. Encouraging open discussions about risk scenarios and mitigation strategies promotes a sense of ownership among stakeholders. When traders feel invested in the risk management process, they are more likely to adhere to strategies and support continuous improvement initiatives. This engagement not only strengthens the risk management plan but also contributes to a more resilient trading environment in the dynamic landscape of financial markets.

Building a Collaborative Risk Culture

A collaborative risk culture is essential for successful risk management within prop firms. Encouraging open communication among team members fosters an environment where everyone feels comfortable sharing insights and concerns about potential risks. This collective approach not only enhances the visibility of emerging threats but also empowers traders to contribute their unique perspectives. By fostering an atmosphere of trust, firms can ensure that risk management becomes an integral part of daily operations, rather than a separate or secondary concern.

In regions like Queensland, promoting collaboration in risk management is particularly important for prop traders facing local and global challenges. Implementing structured workshops and regular team discussions can break down silos within the organisation, allowing for the exchange of ideas and experiences. Additionally, engaging all levels of staff in the risk management process creates a sense of shared ownership, making it more likely that risk mitigation strategies will be prioritised. A unified approach to risk management for prop traders in Logan City can lead to improved decision-making and ultimately a more resilient trading environment.

Reviewing and Updating the Risk Plan

Regularly reviewing and updating a risk management plan is crucial to ensure it remains effective amid changing market conditions and organisational goals. This process involves assessing the existing plan's performance and identifying areas where enhancements can be made. Feedback from stakeholders, including traders and risk analysts, plays a significant role in this evaluation. It is also important to monitor the effectiveness of the risk controls currently in place, as well as any emerging threats or opportunities in the trading environment.

Incorporating ongoing updates into the risk management framework supports proactive risk assessment and ensures that the strategies employed will protect the firm's interests. For those engaged in risk management for prop traders in Queensland, local regulatory changes and economic factors should be considered during the review process. By maintaining a dynamic approach to the risk management plan, firms can adapt swiftly to both challenges and opportunities in the market landscape.

Best Practices for Ongoing Risk Assessment

Ongoing risk assessment is crucial for identifying potential vulnerabilities that can affect trading performance. Regular reviews of trading strategies, market conditions and individual trader behaviours help ensure that the risk management plan stays relevant. Incorporating real-time analytics can provide insights into emerging risks, allowing traders to adjust their strategies promptly. Traders in Queensland, can adopt these practices to maintain a proactive approach to their risk management efforts.

Engaging the entire trading team in risk assessment activities fosters a culture of accountability and transparency. Encouraging open discussions about risks and challenges not only enhances collective knowledge but also stimulates innovative solutions. Continuous education and training on risk management for prop traders in Queensland promote an environment where team members are well-equipped to identify and respond to risks effectively. By institutionalising these practices, firms can better navigate the complexities of the trading landscape.

FAQS

What is a risk management plan in the context of a prop firm?

A risk management plan outlines the strategies and processes a proprietary trading firm employs to identify, assess, and mitigate potential risks that could impact its operations and profitability.

Why is it important to implement monitoring systems for risk management?

Monitoring systems provide real-time data and insights that help identify emerging risks, enabling firms to respond proactively and make informed decisions to protect their assets and investments.

What tools and technologies can be used for risk monitoring in prop firms?

Various tools and technologies, such as risk management software, analytics platforms, and automated trading systems, can be employed to monitor risk factors and enhance decision-making processes.

How can stakeholders be engaged in the risk management process?

Engaging stakeholders involves including them in risk discussions, soliciting their input, and fostering open communication to ensure that everyone understands the risk landscape and contributes to the overall risk culture.

What are some best practices for reviewing and updating a risk management plan?

Best practices include conducting regular risk assessments, involving key stakeholders in reviews, staying updated on market trends, and adjusting the plan based on lessons learned from past experiences or changes in business strategy.