Table Of Contents

Developing a Risk Management Plan

A solid risk management plan is fundamental for success in proprietary trading. Such a plan involves identifying potential risks, assessing their impact, and establishing strategies to mitigate them. For many prop traders, this means creating specific criteria for entering and exiting trades. Detailed guidelines help in maintaining consistency, enabling traders to adhere to their strategies even in moments of market turbulence. This approach not only safeguards capital but enhances decision-making under pressure.

Traders must account for various factors, including asset volatility and global economic fluctuations. Developing a risk management plan tailored to these conditions can provide a competitive edge. Incorporating elements like position sizing and stop-loss orders further refines the strategy. This diligence ensures that prop traders are well-prepared for unexpected changes, which is essential for long-term profitability.

Steps to Create a Comprehensive Strategy

Creating a comprehensive risk management strategy begins with identifying potential risks that could affect trading performance. This involves a thorough analysis of historical data, market trends, and individual asset behaviours. Prop traders in Queensland must consider factors such as liquidity, volatility, and economic indicators as they assess their exposure to different risks. Setting clear risk thresholds is essential, ensuring that traders define acceptable loss limits for each trade, which can help prevent emotional decision-making during market fluctuations.

Once potential risks are identified and thresholds established, the next step is to develop a tailored plan that includes specific risk mitigation techniques. Diversification across various assets and sectors can reduce portfolio volatility. Additionally, implementing stop-loss orders can safeguard against significant losses. For effective risk management for prop traders in Queensland, ongoing education about market conditions and regular reviews of the strategy are crucial. Staying informed allows traders to adapt their approach dynamically in response to evolving market landscapes.

The Impact of Market Conditions on Risk

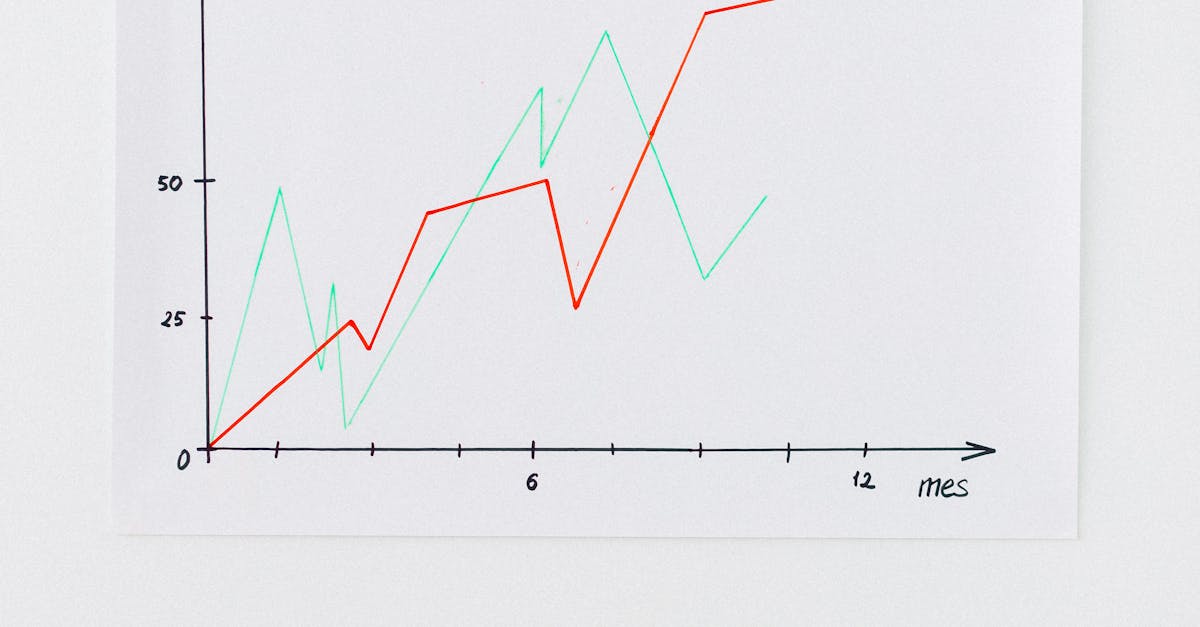

Market conditions play a significant role in the risk profile of proprietary trading firms. Fluctuations in volatility, liquidity, and overall market sentiment can dramatically affect trading strategies and risk exposure. When markets are relatively stable, traders often operate under more predictable circumstances. In contrast, periods of heightened volatility can introduce unexpected challenges, making effective risk assessment essential. Firms need to monitor external indicators that could influence market conditions, as these factors can change swiftly.

In Brisbane, Queensland, risk management for prop traders requires a proactive approach to adapting strategies during varying market conditions. Traders must remain agile, reassessing their tactics and exposure in response to real-time market developments. This adaptability is crucial, particularly in an environment where market dynamics can shift rapidly. By implementing robust risk management strategies, prop traders can navigate uncertainty and protect their capital while still seeking opportunities in diverse market scenarios.

Adjusting Strategies During Volatility

In periods of heightened volatility, it is essential for prop traders to adapt their strategies to mitigate risks. The unpredictability of market movements can significantly impact trading positions and profitability. Traders need to closely monitor their portfolios, assessing both the potential for gains and the likelihood of losses. This involves recalibrating trade sizes, adjusting stop-loss levels, and even diversifying investments to cushion against abrupt market changes.

Implementing effective risk management for prop traders, requires an ongoing evaluation of market conditions and personal risk appetite. Strategies may involve employing technical indicators or analytical tools to help gauge market sentiment and trends. Flexibility in trading approaches allows prop traders to respond swiftly to fluctuations, ensuring they remain responsive and informed in an ever-changing environment.

Regulatory Considerations in Risk Management

Regulatory considerations play a significant role in shaping risk management practices for prop traders. These regulations aim to ensure the stability of financial markets and protect investors from potential losses. Prop trading firms must comply with various requirements set forth by regulatory bodies, which can include maintaining certain capital levels, reporting trades, and adhering to risk assessment protocols. In regions like Cooroy, Queensland, local investors increasingly expect that prop trading firms implement robust risk management frameworks that align with these regulations.

Understanding compliance requirements is essential for successful trading operations. Failing to adhere to regulatory standards can lead to severe penalties and reputational damage. To navigate these complexities, prop traders in Cooroy should develop comprehensive strategies that incorporate risk management principles while also aligning with local laws. Adopting a proactive approach to regulatory compliance not only safeguards the trading firm but also instills confidence in clients and the wider market.

Compliance Requirements for Prop Traders

Compliance requirements for proprietary traders are essential for ensuring accountability and transparency within the financial markets. Regulations vary by region, but there are common frameworks focused on preventing market manipulation, ensuring fair trading practices, and maintaining adequate capital reserves. Prop traders must be aware of these rules to avoid hefty fines and legal consequences. Staying informed about changes in legislation is a vital aspect of sustaining compliance in a dynamic market.

In Australia, specifically concerning risk management for prop traders in Brisbane, Queensland, regulatory bodies such as the Australian Securities and Investments Commission (ASIC) play a significant role. These authorities establish guidelines that traders must follow, including reporting obligations and risk assessment processes. Proper documentation and adherence to these guidelines not only support the integrity of trading practices but can also enhance the reputation of the firm within the competitive landscape.

FAQS

What is risk management in prop trading?

Risk management in prop trading involves identifying, assessing, and mitigating potential losses in trading activities. It includes strategies and practices designed to protect capital while maximising profitability.

Why is risk management crucial for prop traders?

Risk management is crucial for prop traders because it helps safeguard their investments, minimise losses, and ensure long-term sustainability in the highly volatile financial markets. Without effective risk management, traders may experience significant financial setbacks.

What are the key components of a risk management plan?

The key components of a risk management plan include setting risk tolerance levels, determining position sizes, using stop-loss orders, and regularly reviewing and adjusting strategies in response to market conditions.

How can market conditions impact risk management strategies?

Market conditions can significantly impact risk management strategies by influencing volatility, liquidity, and market sentiment. Traders must adapt their risk management approaches to align with these changing conditions to mitigate potential losses.

What regulatory considerations should prop traders be aware of regarding risk management?

Prop traders should be aware of compliance requirements set by financial regulatory bodies, including capital adequacy standards, reporting obligations, and best execution practices. Adhering to these regulations is essential to maintain legitimacy and avoid penalties.